UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

INFORMATION

______________________________

Proxy Statement Pursuant to Section 14(a)

of

the Securities Exchange Act of 1934 (Amendment

(Amendment No. __))

Filed by the Registrant

| S | |

Filed by a Party other than the Registrant | £ |

Check the appropriate box:

£ | Preliminary Proxy Statement | |

£ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

S | Definitive Proxy Statement | |

£ | Definitive Additional Materials | |

£ | Soliciting Material Pursuant to § 240.14a-12 |

PROTARA THERAPEUTICS, INC.

☐ Preliminary(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

☐ Confidential, for UsePayment of Filing Fee (Check the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to § 240.14a-12

appropriate box)

| ||

| No fee required. | ||||

£ | Fee computed on table below per Exchange Act Rules | |||

(1) | ||||

Title of each class of securities to which transaction applies: | ||||

(2) | Aggregate number of securities to which transaction applies: | |||

(3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule | |||

(4) | Proposed maximum aggregate value of transaction: | |||

(5) | Total fee paid: | |||

£ | Fee paid previously with preliminary materials. | |||

£ | Check box if any part of the fee is offset as provided by Exchange Act Rule | |||

(1) | Amount Previously Paid: | |||

(2) | Form, Schedule or Registration Statement No.: | |||

(3) | Filing Party: | |||

(4) | Date Filed: | |||

| ||||

PROTARA THERAPEUTICS, INC.

Proteon Therapeutics, Inc.345 Park Avenue South, Third Floor

New York, New York 10010

200 West Street

Waltham, MA 02451

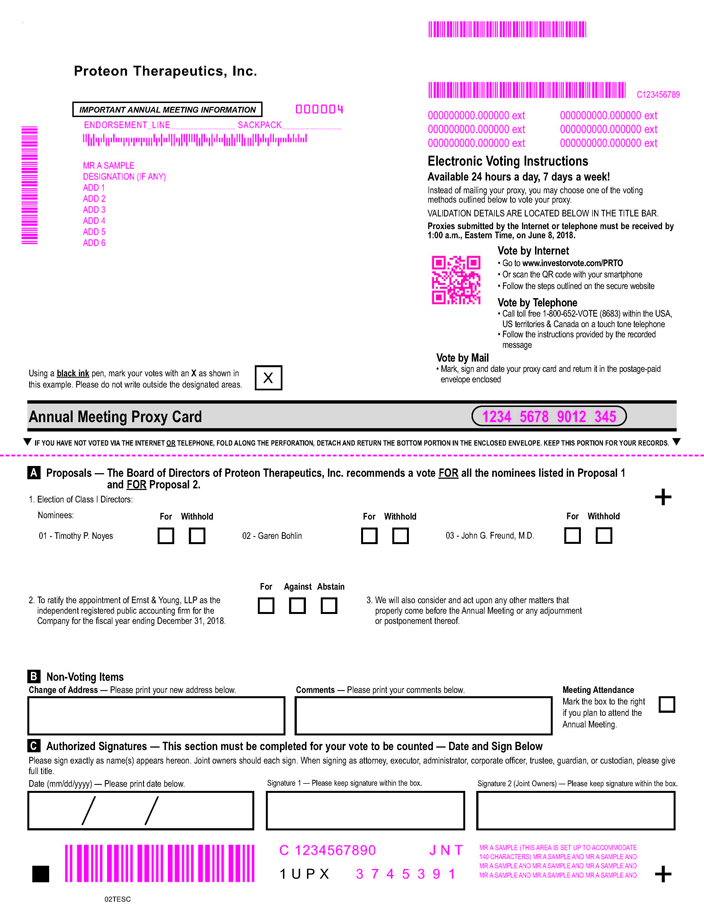

NOTICE OF 2018 ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June9, 2021

The 2018To the Stockholders of Protara Therapeutics, Inc.:

On behalf of our board of directors, you are cordially invited to attend the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of ProteonProtara Therapeutics, Inc., a Delaware corporation (the “Company”, we or “Proteon”). The Annual Meeting will be held virtually, via live webcast at http://www.meetingcenter.io/239488392, originating from New York, New York, on Wednesday, June 8, 2018,9, 2021 at 11:12:00 a.m.p.m. Eastern Time. In light of the COVID-19 pandemic, to support the health and well-being of our stockholders, employees and directors, and taking into account recent federal, state and local time (the “Annual Meeting”),guidance, the Annual Meeting will be held in a virtual meeting format only, via live webcast on the Internet, with no physical in-person meeting. Stockholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at Morgan, Lewis & Bockius LLP, One Federal Street, Boston, Massachusetts 02110 foran in-person meeting. We encourage you to attend online and participate in the purpose of consideringAnnual Meeting, where you will be able to listen to the following two company-sponsored proposals:

meeting live, submit questions and vote. We will also consider and act upon any other mattersrecommend that properly comeyou log in a few minutes before the Annual Meeting or any adjournment or postponement thereof.on June 9, 2021 to ensure you are logged in when the Annual Meeting starts.

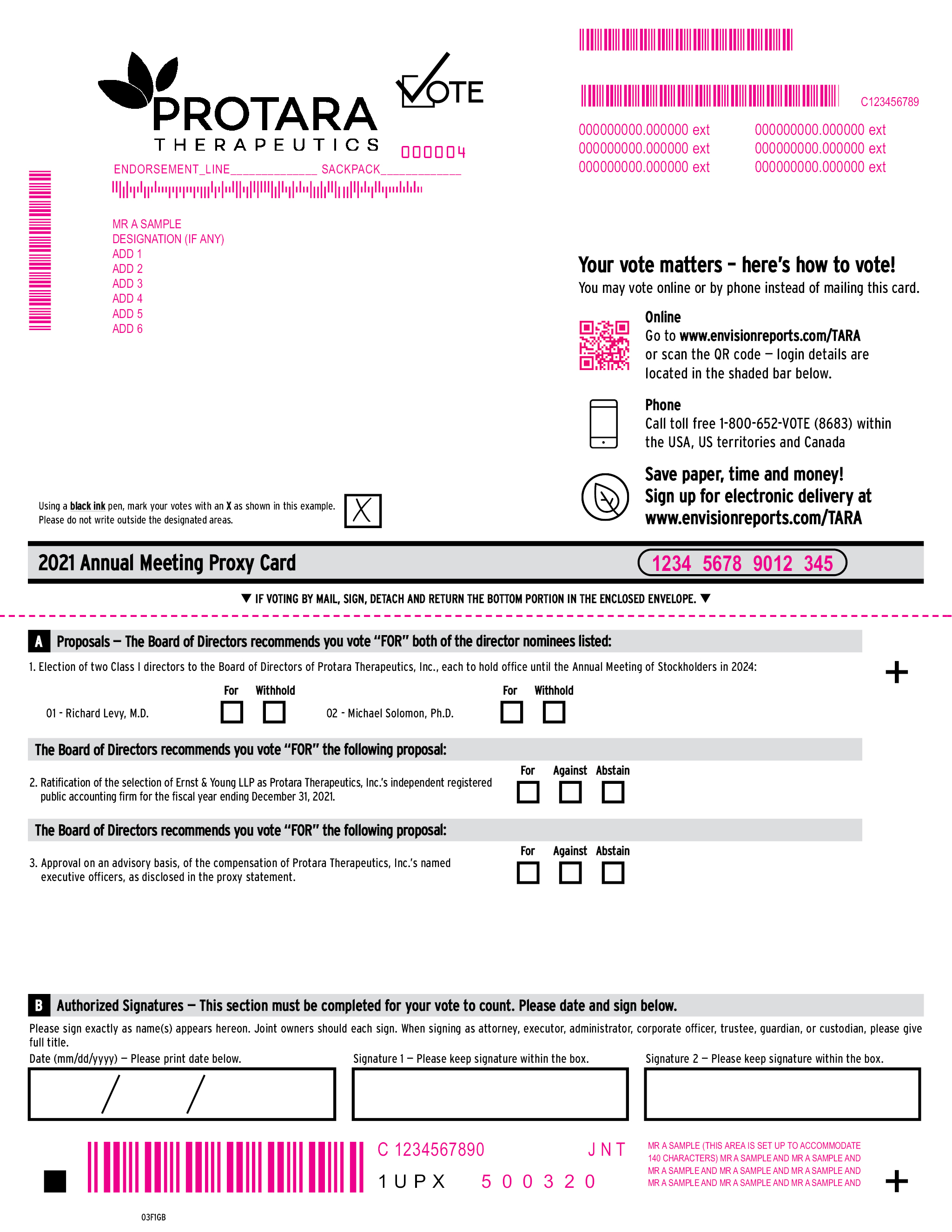

The Annual Meeting will be held for the following purposes:

Our Board of Directors (the “Board”) recommends that you vote “FOR” each of the nominees for1. To elect two Class I director (Proposal No. 1)directors, Richard Levy, M.D. and “FOR” ratificationMichael Solomon, Ph.D., each to hold office until our Annual Meeting of Stockholders in 2024;

2. To ratify the proposedselection by the audit committee of our board of directors of Ernst & Young LLP as our independent registered public accounting firm (Proposal No. 2).for our fiscal year ending December 31, 2021;

3. To approve, on an advisory basis, the compensation of our named executive officers, as disclosed in the accompanying proxy statement; and

The Board has fixed5. To conduct any other business properly brought before the closeAnnual Meeting.

These items of business on April 20, 2018 asare more fully described in the Proxy Statement accompanying this Notice.

The record date for determiningthe Annual Meeting is April 13, 2021. Only stockholders entitled to notice of and to vote at the 2018 Annual Meeting. Therefore, each outstanding share of Proteon’s common stock (Nasdaq: PRTO) entitles the holder of record of such shares at the close of business on April 20, 2018 to receive notice of, and tothat date may vote at the Annual Meeting or any adjournment thereof.

By Order of the Board of Directors | ||

/s/ Blaine Davis | ||

Blaine Davis |

New York, New York

April 27, 2021

You are cordially invited to attend the Annual Meeting. Whether or not you expect to attend the Annual Meeting, PLEASE VOTE YOUR SHARES. As an alternative to voting online at the Annual Meeting, you may vote your shares in advance of the Annual Meeting via the internet, by telephone or, if you receive a paper proxy card by mailing the completed proxy card. Voting instructions are provided in the Notice of Internet Availability of Proxy Materials, or, if you receive a paper proxy card by mail, the instructions are printed on your proxy card. Even if you have voted by proxy, you may still vote online if you attend the Annual Meeting. Please note, however, that if your shares are held of record by a broker, bank or other agent and you wish to vote at the Annual Meeting, you must follow the instructions from such organization and will need to obtain a proxy issued in your name from that record holder. |

i

PROTARA THERAPEUTICS, INC.

345 Park Avenue South, Third Floor

New York, New York 10010

PROXY STATEMENT

FOR THE 2021 ANNUAL MEETING OF STOCKHOLDERS

To Be Held On June 9, 2021 at 12:00 p.m. Eastern Time

Our board of directors is soliciting your proxy to vote at the 2021 Annual Meeting of Stockholders (the “Annual Meeting”) of Protara Therapeutics, Inc., a Delaware corporation, to be held virtually, via live webcast at http://www.meetingcenter.io/239488392, originating from New York, New York, on Wednesday, June 9, 2021 at 12:00 p.m. Eastern Time, and any adjournment or postponement thereof. In light of the COVID-19 pandemic, to support the health and well-being of our stockholders, employees and directors, and taking into account recent federal, state and local guidance, the Annual Meeting will be held in a virtual meeting format only, via live webcast on the Internet, with no physical in-person meeting. Stockholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting.

For the Annual Meeting, we have elected to furnish our proxy materials, including this proxy statement and our Annual Report on Form 10-K for the fiscal year ended December 31, 2020 (the “Annual Report”), to our stockholders primarily via the internet. On or about April 27, 2021, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) that contains notice of the Annual Meeting and instructions on how to access our proxy materials on the internet, how to vote at the Annual Meeting, and how to request printed copies of the proxy materials. Stockholders may request to receive all future materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. A stockholder’s election to receive proxy materials by mail or email will remain in effect until revoked. We encourage stockholders to take advantage of the availability of the proxy materials on the internet to help reduce the environmental impact and cost of our Annual Meeting.

Only stockholders of record of our common stock at the close of business on April 13, 2021 (the “Record Date”) will be entitled to vote at the Annual Meeting. On the Record Date, there were 11,228,606 shares of common stock outstanding and entitled to vote (together, the “common stock”). A list of stockholders entitled to vote at the Annual Meeting will be available for examination during normal business hours for ten days before the Annual Meeting at our address above. To the extent office access is impracticable due to the COVID-19 pandemic, you may email us at info@protaratx.com for alternative arrangements. The stockholder list will also be available online during the Annual Meeting at http://www.meetingcenter.io/239488392. If you plan to attend the Annual Meeting online, please see the instructions on page 2 of this proxy statement.

In this proxy statement, we refer to Protara Therapeutics, Inc. as “Protara,” “we” or “us” and the board of directors of Protara as “our board of directors.” The Annual Report, which contains consolidated financial statements as of and for the fiscal year ended December 31, 2020, accompanies this proxy statement. You also may obtain a copy of the Annual Report without charge by writing to our Secretary at 345 Park Avenue South, Third Floor, New York, New York 10010, Attention: Secretary or emailing info@protaratx.com.

1

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why did I receivea notice regarding the availability of proxy materials on the internet?

Pursuant to rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our proxy materials over the internet. Accordingly, we have sent you the Notice because our board of directors is soliciting your proxy to vote at the 2021 Annual Meeting of Stockholders, including at any adjournments or postponements thereof. All stockholders holding our common stock will have the ability to access the proxy materials on the website referred to in the Notice or to request a printed set of the proxy materials. Instructions on how to access the proxy materials over the internet or to request a printed copy may be found in the Notice.

We intend to mail the Notice on or about April 27, 2021 to all stockholders of record entitled to vote at the Annual Meeting.

Will I receive any other proxy materials by mail?

We may send you a proxy card, along with a second Notice, on or after May 7, 2021.

How do I attend, participate in, and ask questions during the virtual Annual Meeting?

We will be hosting the Annual Meeting via live webcast only. Any holder of record of shares of our common stock can attend the virtual Annual Meeting live online at http://www.meetingcenter.io/239488392. The meeting will start at 12:00 p.m. Eastern Time, on Wednesday, June 9, 2021. Stockholders attending the Annual Meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting.

In order to enter the Annual Meeting, you will need the control number, which is included in the Notice or on your proxy card if you are a stockholder of record of shares of common stock, or included with your voting instruction card and voting instructions received from your broker, bank or other agent if you hold your shares of common stock in a “street name.” Instructions on how to attend and participate online are available at http://www.meetingcenter.io/239488392. We recommend that you log in a few minutes before 12:00 p.m. Eastern Time to ensure you are logged in when the Annual Meeting starts. The webcast will open 15 minutes before the start of the Annual Meeting.

If you would like to submit a question, you may do so no earlier than five days prior to the Annual Meeting, or you may otherwise do so during the Annual Meeting. If you would like to submit your question any time before or during the Annual Meeting, you may log in to http://www.meetingcenter.io/239488392 and enter your control number and meeting password as shown on the Notice. Once past the login screen, click on the question icon at the top of the page. You may then type your question into the question bar at the bottom of the screen, and click the icon to the right of the question bar to submit the question.

AllTo help ensure that we have a productive and efficient meeting, and in fairness to all stockholders in attendance, you will also find posted our rules of conduct for the Annual Meeting when you log in prior to its start. These rules of conduct will include the following guidelines:

• You may submit questions and comments electronically through the meeting portal or by calling the toll-free number listed there during the Annual Meeting.

• Only stockholders of record as of the Record Date for the Annual Meeting and their proxy holders may submit questions or comments.

• Please direct all questions to Jesse Shefferman, our Chief Executive Officer.

• Please include your name and affiliation, if any, when submitting a question or comment.

• Limit your remarks to one brief question or comment that is relevant to the Annual Meeting and/or our business.

• Questions may be grouped by topic by our management.

2

• Questions may also be ruled as out of order if they are, among other things, irrelevant to our business, related to pending or threatened litigation, disorderly, repetitious of statements already made, or in furtherance of the speaker’s own personal, political or business interests.

• Be respectful of your fellow stockholders and Annual Meeting participants.

• No audio or video recordings of the Annual Meeting are permitted.

Who can vote at the Annual Meeting?

Only stockholders of record date, or their duly appointed proxies, may attendof our common stock at the meeting. If you attend, youclose of business on the Record Date, April 13, 2021 will be askedentitled to present valid picture identification such as a driver’s license or passport. vote at the Annual Meeting. On the Record Date, there were 11,228,606 shares of common stock outstanding and entitled to vote.

Stockholder of Record: Shares Registered in Your Name

If, on the Record Date, your Proteonshares of our common stock is heldwere registered directly in a brokerage account or by a bank or other nominee,your name with our transfer agent, Computershare Trust Company, N.A., then you are considered the beneficial ownera stockholder of shares held in street name, and this Proxy Statement is being forwarded to you by your broker or nominee.record. As a result, your name does not appear on our liststockholder of stockholders. If your stock is heldrecord, you may vote online during the Annual Meeting or vote by proxy in street name, in addition to picture identification, you should bring with you a letter or account statement showing that you were the beneficial owner of the stock on the record date, in order to be admitted to the meeting.

advance. Whether or not you expectplan to attend the meeting,Annual Meeting, we urge you to vote your shares by proxy in advance of the Annual Meeting electronically through the internet, by telephone or by signing, datingcompleting and returning a printed proxy card (if you request a printed proxy card in accordance with the instructions provided in the Notice).

Beneficial Owner: Shares Registered in the Name of a Broker or Bank

If, on the Record Date, your shares of our common stock were held, not in your name, but rather in an account at a brokerage firm, bank or other similar organization, then you are the beneficial owner of shares held in “street name” and the Notice is being forwarded to you by that organization. The organization holding your account is considered to be the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank or other agent regarding how to vote the shares in your account. You are also invited to attend the Annual Meeting. However, since you are not the stockholder of record, you may vote your shares online during the Annual Meeting only by following the instructions from such organization and after obtaining a valid proxy from your broker, bank or other agent.

What am I voting on?

There are three matters scheduled for a vote:

• Proposal 1: Election of two Class I directors, each to serve until our annual meeting of stockholders in 2024; and

• Proposal 2: Ratification of the selection by the audit committee of our board of directors of Ernst and Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2021.

• Proposal 3: Approval, on an advisory basis, the compensation of our named executive officers, as disclosed in the proxy card includedstatement.

What if another matter is properly brought before the Annual Meeting?

Our board of directors knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in these materials.the accompanying proxy to vote on those matters in accordance with their best judgment.

3

How do I vote?

The procedures for voting are fairly simple:

• Stockholder of Record: Shares Registered in Your Name. If you chooseare a stockholder of record of our common stock, you may vote (1) in advance of the Annual Meeting by proxy through the internet, by telephone or by using a proxy card that you may request or that we may elect to deliver at a later time or (2) online during the Annual Meeting. Whether or not you plan to attend the Annual Meeting, we urge you to vote by proxy to ensure your vote is counted. You may still attend the Annual Meeting and vote your shares in person,online even if you have previouslyalready voted or returned your proxy by anyproxy.

• To vote in advance of the methods describedAnnual Meeting through the internet, go to www.envisionreports.com/TARA to complete an electronic proxy card. You will be asked to provide the company number and control number from the Notice. Your internet vote must be received by 11:59 p.m., Eastern Time on Tuesday, June 8, 2021 to be counted.

• To vote online during the Annual Meeting, follow the provided instructions to join the Annual Meeting at http://www.meetingcenter.io/239488392, starting at 12:00 p.m. Eastern Time on Wednesday, June 9, 2021. The webcast will open 15 minutes before the start of the Annual Meeting.

• To vote in this Proxy Statement.advance of the Annual Meeting by telephone, dial 1-800-652-VOTE, which is the number found on the Notice or the printed proxy card that may be delivered to you using a touch-tone phone and follow the recorded instructions. You will be asked to provide the company number and control number from the Notice or the printed proxy card. Your telephone vote must be received by 11:59 p.m., Eastern Time on Tuesday, June 8, 2021 to be counted.

• To vote in advance of the Annual Meeting using a printed proxy card that may be delivered to you, simply complete, sign and date the proxy card and return it promptly in the envelope provided. If you return your signed proxy card to us by 11:59 p.m., Eastern Time on Tuesday, June 8, 2021, we will vote your shares as you direct at the Annual Meeting.

• Beneficial Owner: Shares Registered in the Name of Broker or Bank. If you are helda beneficial owner of shares of our common stock registered in streetthe name in aof your broker, bank or brokerage account, please referother agent, you should have received a Notice containing voting instructions from that organization rather than from us. Simply follow the voting instructions in the Notice to ensure that your vote is counted. To vote online during the materials provided byAnnual Meeting, you must follow the instructions from your broker, bank broker or other nominee for voting instructions.

All stockholders are extendedagent and will need to obtain a cordial invitation to attend the meeting.

proxy issued in your name from that record holder.

Internet proxy voting in advance of the Annual Meeting and/or Internet voting during the Annual Meeting allows you to vote your shares online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. Please be aware that you must bear any costs associated with your internet access. | ||||

TABLE OF CONTENTS

Page

Can I vote my shares by filling out and returning the Notice?

Proteon Therapeutics, Inc.

200 West Street

Waltham, MA 02451

PROXY STATEMENT FOR 2018 ANNUAL MEETING OF STOCKHOLDERS

To Be Held On Friday, June 8, 2018 at 11:00 am EDT

AtNo. The Notice identifies the offices of Morgan, Lewis & Bockius LLP,

At One Federal Street, Boston, Massachusetts 02110

When are this proxy statement and the accompanying material scheduleditems to be sentvoted on at the Annual Meeting, but you cannot vote by marking the Notice and returning it. The Notice provides instructions on how to stockholders?

Thisvote by proxy statement (the “Proxy Statement”) and accompanyingin advance of the Annual Meeting through the internet, by telephone, by using a printed proxy card or for shares held in street name (held for your account by submitting a broker or other nominee), voting instruction form, are scheduled to be first sent to stockholders beginning on or about May 1, 2018.

Who is soliciting my vote?

The Board of Directors (the “Board”) of Proteon Therapeutics, Inc. (the “Company”, “we” or “Proteon”) is soliciting your vote for the 2018 Annual Meeting of Stockholders.

When is the record date forballot online during the Annual Meeting?Meeting.

What does it mean if I receive more than one Notice?

Proteon’s Board has fixedIf you receive more than one Notice, your shares of our common stock may be registered in more than one name or in different accounts. Please follow the record date for the Annual Meeting asvoting instructions on all of the closeNotices that you receive to ensure that all of business on April 20, 2018.your shares are voted.

4

Can I change my vote after submitting my proxy?

How many votes can be cast by all stockholders?

A total• Stockholder of 17,674,729 sharesRecord: Shares Registered in Your Name. If you are a stockholder of record of our common stock, of Proteon were outstanding on April 20, 2018 and are entitled to be votedthen yes, you can revoke your proxy at any time before the final vote at the Annual Meeting. Each shareYou may revoke your proxy in any one of the following ways:

• Submit another properly completed proxy card with a later date.

• Grant a subsequent proxy by telephone or through the internet.

• Send a timely written notice that you are revoking your proxy to our Secretary at 345 Park Avenue South, Third Floor, New York, New York 10010, Attention: Secretary or via email at info@protaratx.com.

• Attend the Annual Meeting and vote online during the meeting. Simply attending the Annual Meeting will not, by itself, revoke your proxy. Even if you plan to attend the Annual Meeting, we recommend that you also submit your proxy or voting instructions or vote by telephone or through the internet in advance of the Annual Meeting so that your vote will be counted if you later decide not to attend the Annual Meeting.

• Your most current proxy card or telephone or internet proxy is the one that is counted.

• Beneficial Owner: Shares Registered in the Name of Broker or Bank. If you are a beneficial owner of shares of our common stock is entitled to oneand your shares are held in “street name” by your broker, bank or other agent, you should follow the instructions provided by your broker, bank or other agent.

If I am a stockholder of record and I do not vote, on each matter presented at the Annual Meeting. There is no cumulative voting.

How door if I vote?

return a proxy card or otherwise vote without giving specific voting instructions, what happens?

If you are a stockholder of record of our common stock and your shares are registered directly in your name, you may vote:

If your shares of common stock are held in street name (held for your account by a broker or other nominee), you may vote:

What are the Board’s recommendations on how to vote my shares?

The Board recommends a vote:

Who pays the cost for soliciting proxies?

Proteon will bear the cost of solicitation of proxies. This includes the charges and expenses of brokerage firms and others for forwarding solicitation material to beneficial owners of our outstanding common stock. Proteon may solicit proxies by mail, personal interview, telephone or via the internet through its officers, directors and other management employees, who will receive no additional compensation for their services.

Can I change or revoke my vote?

You may revoke your proxy at any time before it is voted by notifying the Secretary of Proteon in writing at the principal executive offices, by returning a signed proxy with a later date, by transmitting a subsequent vote over the internet or by telephone prior to the close of the internet voting facility or the telephone voting facility, or by attending the meeting and voting in person. If your stock is held in street name, you must contact your broker or nominee for instructions as to how to change or revoke your vote.

How is a quorum reached?

The presence, in person or by proxy, of holders of at least a majority of the issued and outstanding shares entitled to vote is necessary to constitute a quorum for the transaction of business at the Annual Meeting. Abstentions and “broker non-votes,” if any, will be counted as present and entitled to vote for purposes of determining whether a quorum is present for the transaction of business at the meeting.

“Broker non-votes” are shares representedpresented at the Annual Meeting, held by brokers, bankers or other nominees (i.e., in “street name”) and do not voteyour proxyholder (one of the individuals named on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received instructions from the beneficial owner. Generally, brokerage firms may vote to ratify the selection of independent auditors and on other “discretionary” or “routine” items. In contrast, brokerage firms may not vote to elect directors, because those proposals are considered “non-discretionary” items. Accordingly, if you do not instruct your broker how toproxy card) will vote your shares on “non-discretionary” matters, yourusing his or her best judgment.

If I am a beneficial owner of shares held in “street name” and I do not provide my broker, will not be permitted to vote your shares on these matters. This isbank or other agent with voting instructions, what happens?

If you are a “broker non- vote.”

What vote is required to approve each item?

Required Vote - Election of Directors (Proposal No. 1). Directors shall be elected by a plurality of the votes cast, present in person or represented by proxy at the Annual Meeting and entitled to vote on the election of directors. This means that the three individuals receiving the highest number of “FOR” votes will be elected as directors. Abstentions and broker non-votes will not be treated as votes cast for this purpose and, therefore, will not affect the outcome of the election.

Required Vote - Ratification of the Selection of Independent Registered Public Accounting Firm (Proposal No. 2). The affirmative vote of a majoritybeneficial owner of shares of our common stock present in person or represented by proxy at the Annual Meeting and entitled to vote on the selection of independent auditors, is required to ratify the selection of our independent auditors. An abstention is treated as present and entitled to vote and, therefore, has the effect of a vote “against” ratification of the independent auditors. Because the ratification of the independent auditors is routine matter, a nominee holding shares in street name may vote on this proposal in the absence of instructions from the beneficial owner.

If there are insufficient votes to approve these proposals,do not instruct your proxy may be voted by the persons named in the proxy card to adjourn the Annual Meeting in order to solicit additional proxies in favor of the approval of such proposal(s). If the Annual Meeting is adjourned or postponed for any purpose, at any subsequent reconvening of the meeting, your proxy will be voted in the same manner as it would have been voted at the original convening of the Annual Meeting unless you withdraw or revoke your proxy.

Could other matters be decided at the Annual Meeting?

Proteon does not know of any other matters that may be presented for action at the Annual Meeting. Should any other business properly come before the meeting, the persons named on the enclosed proxy will have discretionary authority to vote the shares represented by such proxies in accordance with their best judgment to the same extent as the person signing the proxy would be entitled to vote. If you hold shares through a broker, bank or other agent how to vote your shares, the question of whether your broker or nominee as described above, they will notstill be able to vote your shares depends on any other business that comes beforewhether, pursuant to stock exchange rules, the Annual Meeting unless they receive instructions from you with respect to such matter.

What happens if the meetingparticular proposal is postponed or adjourned?

Your proxy may be voted at the postponed or adjourned meeting. You will still be able to change your proxy until it is voted.

What does it mean if I receive more than one proxy card or voting instruction form?

It means that you have multiple accounts at the transfer agent or with brokers. Please complete and return all proxy cards or voting instruction forms to ensure that all of your shares are voted.

Where can I find the voting results of the meeting?

The preliminary voting results will be announced at the Annual Meeting. The final results will be disclosed in a Current Report on Form 8-K within four business days after the meeting date.

What are the implications of being an “emerging growth company?”

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups (JOBS) Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements. These reduced reporting requirements include reduced disclosure about Proteon’s executive compensation arrangements and no non-binding advisory votes on executive compensation. We will remain an emerging growth company until the earlier of (1) the last day of the fiscal year (a) following the fifth anniversary of the completion of our initial public offering on October 27, 2014, (b) in which we have total annual gross revenue of at least $1.0 billion, or (c) in which we are deemed to be a large accelerated filer, which means“routine” matter. Brokers and nominees can use their discretion to vote “uninstructed” shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. Under applicable rules and interpretations, “non-routine” matters are matters that may substantially affect the market valuerights or privileges of our common stock that is held by non-affiliates exceeds $700 millionstockholders, such as mergers, stockholder proposals, elections of the prior June 30th,directors (even if not contested), executive compensation, and (2) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period.

Who should I callcertain corporate governance proposals, even if I have any additional questions?

If you hold your shares directly, please call Matthew P. Kowalsky, Secretary of the Company, at (781) 890-0102. If your shares are held in street name, please contact the telephone number provided on your voting instruction form or contactmanagement-supported. Accordingly, your broker or nominee holder directly.

may vote your shares of common stock on Proposal 2. Your broker or nominee, however, may not vote your shares on Proposals 1 or 3 without your instructions. Such an event would result in a “broker non-vote” and these shares will not be counted as having been voted on Proposals 1 or 3. Please instruct your bank, broker or other agent to ensure that your vote will be counted.

5

Important Notice RegardingTable of Contents

What are “broker non-votes”?

As discussed above, when a beneficial owner of shares held in “street name” does not give instructions to the Availability of Proxy Materials forbroker or nominee holding the

2018 Annual Meeting of Stockholders shares as to how to vote on matters deemed to be Held on June 8, 2018“non-routine,” the broker or nominee cannot vote the shares. These unvoted shares are counted as “broker non-votes.”

As a reminder, if you a beneficial owner of shares held in “street name,” in order to ensure your shares are voted in the way you would prefer, you must provide voting instructions to your broker, bank or other agent by the deadline provided in the materials you receive from such organization.

The NoticeHow are votes counted?

Votes will be counted by the inspector of 2018 Annual Meeting of Stockholders, this Proxy Statement and our Annual Report on Form 10-K are available free of charge at http://www.edocumentview.com/PRTO or www.proteontherapuetics.com under “Investors & Media” at “SEC Filings.” Directions toelection appointed for the Annual Meeting, are included onwho will separately count, (i) for the form of Proxy Card included herein.

PROPOSAL NO. 1—ELECTION OF DIRECTORS

In accordanceproposal to elect directors, votes “FOR,” “WITHHOLD,” abstentions and broker non-votes; (ii) with Proteon’s certificate of incorporation and bylaws, the Board is divided into three classes of directors of approximately equal size. The members of each class of directors are elected to serve a three-year term with the term of office of each class ending in successive years. Timothy P. Noyes, Garen Bohlin and John G. Freund, M.D. are the Class I directors whose terms expire at Proteon’s 2018 Annual Meeting of stockholders. Each of Timothy P. Noyes, Garen Bohlin and John G. Freund, M.D. has been nominated for, and has agreed to stand for, re-electionrespect to the Boardproposal to serveratify the selection of Ernst & Young LLP as a Class I directorour independent registered public accounting firm for the fiscal year ending December 31, 2021, votes “FOR,” “AGAINST” and abstentions; and (iii) with respect to the proposal to approve, on an advisory basis, the compensation of Proteon for three years untilour named executive officers, votes “FOR,” “AGAINST,” abstentions and broker non-votes. For Proposal 1, withhold votes, abstentions and broker non-votes have no effect. For Proposals 2 and 3, an abstention will have the 2021 Annual Meetingsame effect as an “AGAINST” vote and until their successorsbroker non-votes will have no effect.

How many votes are duly elected and qualified or until their earlier death, resignation or removal.needed to approve each proposal?

It is intended that, unless you give contrary instructions, shares represented by proxies will be voted for• Proposal 1: For the election of eachdirectors, the two nominees receiving the most “FOR” votes from the holders of the three nominees listed above as director nominees. Proteon has no reason to believe that any nominee will be unable to serve. In the event that one or more nominees is unexpectedly not available to serve, proxies may be voted for another person nominated as a substituteshares present by the Board, or the Board may reduce the number of directors to be elected at the Annual Meeting. Information relating to each nominee for election as director and for each continuing director, including his or her period of service as a director of Proteon, principal occupation and other biographical material, is included below.

VOTE REQUIRED

A plurality of the votes cast, present in personvirtual attendance or represented by proxy at the meeting that areand entitled to vote on the election of directors will be required forelected. Only votes “FOR” will affect the electionoutcome.

• Proposal 2: To be approved, the ratification of the Class I director nominees. The three nomineesselection of Ernst & Young LLP as our independent registered public accounting firm for director with the highest number of affirmativefiscal year ending December 31, 2021 must receive “FOR” votes will be elected as directors. Broker non-votes and abstentions will not be treated as votes cast for this purpose and, therefore, will not affect the outcome of the election.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THESE NOMINEES FOR CLASS I DIRECTOR.

(PROPOSAL NO. 1 ON YOUR PROXY CARD)

Board Composition and Structure

Our certificate of incorporation and bylaws state that our Board shall consist of a number of directors that shall be fixed exclusively by the Board from time to time in accordance with the bylaws of the Company. Each director holds office until his or her successor is duly elected and qualified or until his or her death, incapacity, resignation or removal. Our certificate of incorporation provides that our directors may be removed only for cause by the affirmative vote of the holders of a majority of shares present by virtual attendance or represented by proxy and entitled to vote on the matter. Abstentions will have the same effect as an “AGAINST” vote. We do not expect any broker non-votes for Proposal 2.

• Proposal 3: To be approved, on an advisory basis, the compensation of our named executive officers must receive “FOR” votes from the holders of a majority of shares present by virtual attendance or represented by proxy and entitled to vote on the matter. Abstentions will have the same effect as an “AGAINST” vote and broker non-votes will have no effect.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if stockholders holding at least 75% of the voting powera majority of the outstanding shares of capitalcommon stock of Proteon entitled to vote inare present at the electionAnnual Meeting by virtual attendance or represented by proxy. On the Record Date, there were 11,228,606 shares of directorscommon stock outstanding and entitled to vote. Thus, the holders of 5,614,304 shares must be present by virtual attendance or classrepresented by proxy at the Annual Meeting to have a quorum.

Your shares of directors, voting together ascommon stock will be counted towards the quorum only if you submit a single class, at a meeting ofvalid proxy (or one is submitted on your behalf by your broker, bank or other agent) or if you vote online during the stockholders called for that purpose. Any vacancy inAnnual Meeting. Abstentions and broker non-votes will be counted towards the Board, including a vacancy that results from an increase inquorum requirement. If there is no quorum, the number of directors, may be filled only by the voteholders of a majority of shares of common stock present at the remainingAnnual Meeting by virtual attendance or represented by proxy may adjourn the Annual Meeting to another date.

How can I find out the results of the voting at the Annual Meeting?

Preliminary voting results will be announced at the Annual Meeting. In addition, final voting results will be published in a current report on Form 8-K that we expect to file within four business days after the Annual Meeting. If final voting results are not available to us in time to file a Form 8-K within four business days after the Annual Meeting, we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file an additional Form 8-K to publish the final results.

6

When are stockholder proposals due for next year’s annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 28, 2021, to our Secretary at 345 Park Avenue South, Third Floor, New York, New York 10010, Attention: Secretary.

Pursuant to our amended and restated bylaws, if you wish to submit a proposal (including a director nomination) at the 2022 annual meeting that is not to be included in next year’s proxy materials, you must do so not later than the close of business on March 11, 2022 nor earlier than the close of business on February 9, 2022. However, if the date of our 2022 annual meeting is not held between May 10, 2022 and August 18, 2022, to be timely, notice by the stockholder must be received not later than the close of business on the 10th day following the day on which public announcement of the date of the 2022 annual meeting is first made. You are also advised to review our amended and restated bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations.

Who is paying for this proxy solicitation?

We will pay for the cost of soliciting proxies. In addition to these proxy materials, our directors thenand employees may also solicit proxies in office, although less than a quorum,person, by telephone or by other means of communication. Directors and employees will not be paid additional compensation for soliciting proxies. We may reimburse brokers, banks and other agents for the sole remaining director.cost of forwarding proxy materials to beneficial owners.

Why do you discuss a merger and a financing in this Proxy Statement?

Our certificate of incorporation provides that our Board is divided into three classes of directors, with the classes as nearly equal in number as possible. Each of our directors identified below serves in the class indicated. Subject to any earlier resignation or removalOn January 9, 2020, we (formerly Proteon Therapeutics, Inc.), and privately-held ArTara Subsidiary, Inc. (“Private ArTara”), completed a merger and reorganization (the “Merger”), in accordance with the terms of the Agreement and Plan of Merger and Reorganization, dated September 23, 2019 (the “Merger Agreement”), by and among the Company, Private ArTara and REM 1 Acquisition, Inc., our certificatewholly owned subsidiary (“Merger Sub”), whereby Merger Sub merged with and into Private ArTara, with Private ArTara surviving as our wholly owned subsidiary. The Merger was structured as a reverse merger and Private ArTara was determined to be the accounting acquirer based on the terms of incorporationthe Merger and bylaws,other factors.

On January 9, 2020, in connection with, and prior to the completion of, the Merger, the Company effected a 1-for-40 reverse stock split of its common stock (the “Reverse Stock Split”), Private ArTara changed its name from “ArTara Therapeutics, Inc.” to “ArTara Subsidiary, Inc.”, and we changed our current Class Iname from “Proteon Therapeutics, Inc.” to “ArTara Therapeutics, Inc.” On May 11, 2020, we changed our name from ArTara Therapeutics, Inc. to Protara Therapeutics, Inc. In addition, on January 9, 2020, all of the outstanding shares of our Series A Preferred Stock were converted into shares of common stock. Shares of our common stock commenced trading on The Nasdaq Capital Market under the new name and ticker symbol “TARA” as of market open on January 10, 2020. Unless otherwise noted, all references to share amounts in this Proxy Statement reflect the Reverse Stock Split.

7

ELECTION OF DIRECTORS

Our board of directors will serve untilcurrently consists of eight members and is divided into three classes. Each class consists, as nearly as possible, of one-third of the 2018total number of directors, and each class has a three-year term.

At each annual meeting of stockholders; our current stockholders, the successors to directors whose terms then expire will be elected to serve from the time of election until the third annual meeting following the election. Our directors are divided into the three classes as follows:

• Class I directors: Richard Levy, M.D. and Michael Solomon, Ph.D., whose terms will expire at the upcoming Annual Meeting;

• Class II directorsdirectors: Luke Beshar, Roger Garceau, M.D. and Gregory Sargen, whose terms will serve untilexpire at the 2019 annual meeting of stockholders;stockholders to be held in 2022; and our current

• Class III directorsdirectors: Jesse Shefferman, Barry Flannelly, Pharm.D, MBA and Cynthia Smith, whose terms will serve untilexpire at the 2020 annual meeting of stockholders. stockholders to be held in 2023.

Any additional directorships resulting from an increase in the number of directors will be apportioned by our boarddistributed among the three classes.

In addition, pursuant to our certificateclasses so that, as nearly as possible, each class will consist of incorporation and the certificate of designation related thereto, the holders of a majorityone-third of the outstanding shares of our Series A Convertible Preferred Stock (“Series A Preferred Stock”) are entitled to elect one member of the Board (the “Series A Director”). The Series A Director holds office until the following year’s annual meeting and until his or her successor is duly elected or qualified by the written consent of the holders of a majority of the outstanding shares of Series A Preferred Stock or until his or her earlier death, incapacity, resignation or removal. The Series A Director may be removed from office, with or without cause, upon the written consent of the holders of a majority of the outstanding shares of Series A Preferred Stock, and the holders of a majority of the outstanding shares of Series A Preferred Stock shall have the power to fill, by written consent, any vacancy caused by the resignation, death or removal of such Series A Director. For purposes of clarity, the Series A Director is not classified with the remaining members of the Board.

Our Board is currently comprised of nine members. Below is a list of the names, ages as of April 20, 2018 and classification of the individuals who currently serve as our directors.

In consultation with the Governance and Nominating Committee, the Board has determined that, except for the Series A Director, the classified board structure is appropriate for the Company, particularly following its initial public offering. A classified board provides for stability, continuity and experience among our Board. Further, the Board believes that building a cohesive board of directors is an important goal, which was only recently established in its current form. In our industry in particular, long-term focus is critical. The time horizon required for successful development of pharmaceuticals makes it vital that we have a board that understands the implications of this process and has the ability to develop and implement long-term strategies while benefiting from an in-depth knowledge of Proteon’s business and operations. A classified board structure helps to ensure that there will be the continuity and stability of leadership required to navigate a challenging economic environment while resisting the pressure to focus on short-term results at the expense of the long-term value and success of the Company. The future success of Proteon depends in significant part on the ability to attract and retain capable and experienced directors. In this regard, we believe that longer terms for our directors will enhance director independence from both management and stockholder special interest groups.

Information concerning our directors is set forth below. The biographical description of each director includes the specific experience, qualifications, attributes and skills that the Board would expect to consider if it were making a conclusion currently as to whether such person should serve as a director.

Class I Directors (Nominees Standing for Election)

Timothy P. Noyes joined Proteon in April 2006 as our President and Chief Executive Officer and has also been a member of our Board since joining Proteon. From 2002 to 2006, Mr. Noyes served as Chief Operating Officer of Trine Pharmaceuticals, Inc. Before joining Trine, Mr. Noyes held several management positions with GelTex Pharmaceuticals from 1996 to 2001, prior to its acquisition by Genzyme Corporation. After the acquisition, from 2001 to 2002, he held the positions of President, Renal Division and President, GelTex Pharmaceuticals. Prior to GelTex, he worked for several years at Merck & Co. across multiple roles in its hypertension and heart failure group and managed care division, and on its Vasotec and Prilosec products. Mr. Noyes received an A.B. from Harvard College and an M.B.A. from Harvard Business School. We believe Mr. Noyes is qualified to serve as a member of our Board because of his role with us and his extensive operational knowledge of, and executive level management experience in, the biopharmaceutical industry.

Garen Bohlin has been a member of our Board since September 2014. Since May 2012, Mr. Bohlin has servedVacancies on the board of directors to various life sciences and healthcare companies. From January 2010 until April 2012, he served as Executive Vice Presidentmay be filled only by persons elected by a majority of Constellation Pharmaceuticals, a biopharmaceutical company. Prior to joining Constellation Pharmaceuticals, Mr. Bohlin served as Chief Operating Officer of Sirtris Pharmaceuticals, a biopharmaceutical company, from January 2006 to December 2009. Mr. Bohlin was the founding Chief Executive Officer of Syntonix Pharmaceuticals, Inc., a biopharmaceutical company, from 1999 through December 2005. Earlier in his career, he held multiple executive positions at Genetics Institute, Inc., a biopharmaceutical company, and was a partner at Arthur Andersen & Co., a public accounting and consulting organization. Mr. Bohlin currently serves onremaining directors. A director elected by the board of directors to fill a vacancy in a class, including vacancies created by an increase in the number of Tetraphase Pharmaceuticals, Inc. (Nasdaq: TTPH), Karyopharm Therapeutics, Inc. (Nasdaq: KPTI)directors, shall serve for the remainder of the full term of that class and Collegium Pharmaceutical, Inc. (Nasdaq: COLL), all Nasdaq listed companies. Heuntil the director’s successor is duly elected and qualified. The division of our board of directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of the Company.

Drs. Levy and Solomon are currently members of our board of directors and have been nominated for reelection to serve as Class I directors. Each of these nominees has agreed to stand for reelection at the Annual Meeting. Our management has no reason to believe that any nominee will be unable to serve. If elected at the Annual Meeting, each of these nominees would serve until the annual meeting of stockholders to be held in 2024 and until his successor has been duly elected, or if sooner, until the director’s death, resignation or removal.

Directors are elected by a plurality of the votes of the holders of shares of our common stock present by virtual attendance or represented by proxy and entitled to vote on the election of directors. Accordingly, the two nominees receiving the highest number of affirmative votes will be elected. Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the two nominees, Drs. Levy and Solomon. If any nominee becomes unavailable for election as a result of an unexpected occurrence, shares that would have been voted for that nominee will instead will be voted for the election of a substitute nominee proposed by us.

Our nominating and corporate governance committee seeks to assemble a board that, as a whole, possesses the appropriate balance of professional and industry knowledge, financial expertise, diversity and high-level management experience necessary to oversee and direct our business. To that end, the committee has identified and evaluated nominees in the broader context of the board’s overall composition, with the goal of recruiting members who complement and strengthen the skills of other members and who also servedexhibit integrity, collegiality, sound business judgment and other qualities that the committee views as critical to effective functioning of the board. To provide a mix of experience and perspective on the board, the committee also takes into account geographic, gender, age, and ethnic diversity. The biographies below include information, as of directors for Acusphere, Inc. (OTCMKTS: ACUS) from 2005the date of this proxy statement, regarding the specific and particular experience, qualifications, attributes or skills of each director or director nominee that led the committee to January 2015, Praecis Pharmaceuticals, Inc. from 2005 to 2007, Targanta Therapeutics, Inc. (Nasdaq: TARG) from 2007 to 2009, SpringLeaf Therapeutics from 2010 to 2013 and Precision Dermatology from 2012 to 2014. Mr. Bohlin received his B.S. in accounting and finance from The University of Illinois. We believe that Mr. Bohlin is qualifiedthat nominee should continue to serve on the board. However, each of the members of the committee may have a variety of reasons why a particular person would be an appropriate nominee for the board, and these views may differ from the views of other members.

Our Board Of Directors Recommends A Vote FOR Each Class I Director Nominee Named Above.

8

Information Regarding Director Nominees and Current Directors

The following table sets forth, for the Class I nominees and our Board becauseother directors who will continue in office after the Annual Meeting, their ages and position or office held with us as of his industrythe date of this proxy statement:

Name | Age | Position | ||

Class I director nominees for election at the 2021 Annual Meeting of Stockholders | ||||

Richard Levy, M.D. | 63 | Director | ||

Michael Solomon, Ph.D. | 51 | Director | ||

Class II directors continuing in office until the 2022 Annual Meeting of Stockholders | ||||

Luke Beshar | 62 | Chairman of the Board | ||

Roger Garceau, M.D. | 67 | Director | ||

Gregory Sargen | 55 | Director | ||

Class III directors continuing in office until the 2023 Annual Meeting of Stockholders | ||||

Jesse Shefferman | 49 | Chief Executive Officer and Director | ||

Barry Flannelly, Pharm.D, MBA | 63 | Director | ||

Cynthia Smith | 52 | Director |

Set forth below is biographical information for the director nominees and board experience, including his audit committee experience, with publicly traded biopharmaceutical companies.

John G. Freund, M.D. has been a membereach person whose term of our Board since February 2014. Dr. Freund co-founded Skyline Ventures, a venture capital firm, in September 1997, where he has servedoffice as a partner since its founding. Prior to founding Skyline, Dr. Freund served as Managing Director indirector will continue after the private equity group of Chancellor Capital Management from 1995 to 1997. In 1995, he co-founded Intuitive Surgical, Inc. and served on itsAnnual Meeting. This includes information regarding each director’s experience, qualifications, attributes or skills that led our board of directors until 2000. From 1988 to 1994, Dr. Freund served in various positions at Acuson Corporation, now part of Siemens, most recently as Executive Vice President. Prior to joining Acuson, Dr. Freund was a General Partner of Morgan Stanley Venture Partners from 1987 to 1988. From 1982 to 1988, Dr. Freund worked at Morgan Stanley & Co., where he co-founded the Healthcare Group in the Corporate Finance Department. Dr. Freund currently serves as a member of therecommend them for board of directors of Collegium Pharmaceutical, Inc. (Nasdaq: COLL) and Tetraphase Pharmaceuticals, Inc. (Nasdaq: TTPH). He also previously served on the board of directors of a number of publicly traded companies, including Map Pharmaceuticals, a biopharmaceutical company (Nasdaq: MAPP), Mako Surgical Corp., a medical device company (Nasdaq: MAKO), Concert Pharmaceuticals, Inc., a biopharmaceutical company (Nasdaq: CNCE) and was Chairman of XenoPort, Inc., a biopharmaceutical company (Nasdaq: XNPT). He also serves on the board of directors of six U.S. registered investment funds managed by affiliates of the Capital Group, Inc. He is a member of the Advisory Board for the Harvard Business School Healthcare Initiative. He received an A.B. in history from Harvard College, an M.D. from Harvard Medical School and an M.B.A. from Harvard Business School, where he was a Baker Scholar and won the Loeb Fellowship in Finance. We believe Dr. Freund is qualified to serve as a member of our Board because of his training as a physician and his extensive investment, business and board experience with public healthcare and biopharmaceutical companies.service.

Current Directors Not StandingNominees for Election at the 2021 Annual Meeting of Stockholders

Hubert Birner, Ph.D. has been a member of our Board since 2007. Dr. Birner is the managing partner of TVM Capital, a venture capital firm, which he joined in 2000. Before joining TVM Capital, Dr. Birner served as Head of Business Development Europe and Director of Marketing for Germany at Zeneca from 1998 to 2000. Dr. Birner joined Zeneca from McKinsey & Company’s European Health Care and Pharmaceutical practice where he worked from 1995 to 1998. From 1992 to 1994, Dr. Birner was also an Assistant Professor for biochemistry at the Ludwig-Maximilian-University in Munich. Dr. Birner currently serves as Chairman of the Board of Argos Therapeutics Inc., a publically traded company (Nasdaq: ARGS), and also currently serves as Chairman of the Board of Spepharm Holding BV, NOXXON Pharma AG Berlina and leon nanodrugs, all private companies. He previouslyRichard Levy, M.D. served as a member of the board of directors of Horizon Pharma (Nasdaq: HZNP), Evotec AG (EVT: ETR), Probiodrug AGPrivate ArTara from December 2019 until the Merger, and BioXell SPA. Dr. Birner received an M.B.A. from Harvard Business School and a Ph.D. in biochemistry from Ludwig-Maximilian-University Munich, where he graduated summa cum laude. We believe Dr. Birner is qualified to serve as a member of our Board because of his investment, business, research and board experience in the life sciences industry.

Scott A. Canute has been a member of our Board since July 2015. Mr. Canute served as President of Global Manufacturing and Corporate Operations at Genzyme Corporation from 2010 to 2011. Prior to joining Genzyme, Mr. Canute spent 25 years at Eli Lilly and Company and served as President, Global Manufacturing Operations from 2004 to 2007. Mr. Canute currently serves as a member of the board of directors of Flexion Therapeutics, Inc. (Nasdaq: FLXN), Akebia Therapeutics, Inc. (Nasdaq: AKBA) and Immunomedics, Inc. (Nasdaq: IMMU), all of which are publicly traded companies. Mr. Canute previously served as a member of the board of directors of AlloCure, Inc., Inspiration Biopharmaceuticals, Inc., Oncobiologics, Inc. (Nasdaq: ONS), the National Association of Manufacturers and the Indiana Manufacturers Association. Mr. Canute earned a B.S. in chemical engineering from the University of Michigan and an M.B.A. from Harvard Business School. We believe that Mr. Canute is qualified to serve as a member of our Board because of his manufacturing and operational experience in the biopharmaceutical industry.

Tim Haines has been a member of our Board since May 2014. Tim is Managing Partner at Abingworth LLP, a leading global life sciences venture investment firm. Tim joined Abingworth in 2005 having been Chief Executive of the Abingworth portfolio company, Astex Therapeutics. He was instrumental in establishing it as one of the leading UK biotechnology companies. Astex was acquired by Otsuka Pharmaceuticals and recently had a breakthrough drug for Breast Cancer approved by FDA. Previously, Tim held Chief Executive positions at Datascope Corp. (Nasdaq) and Thackray Inc. (J&J Depuy acquired), and was General Manager Baxter UK. Current and past board positions include; Chroma, Fovea (Sanofi Aventis acquired), Stanmore (Stryker acquired) HBI (Meda acquired), Pixium Vision (Euronext), PowderMed (Pfizer acquired), Proteon (Nasdaq), Sientra (Nasdaq), GammaDelta Therapeutics and Virion Health. Tim has a BSc from Exeter University and an MBA from INSEAD and is a former Director of the BIA, and sat on the BVCA Venture Committee and the Wellcome Trust / NHS Health Innovation Challenge Fund. We believe Mr. Haines is qualified to serve as a member of our Board because of his management, investment and board experience in the life sciences industry.

Paul J. Hastingshas served as a member of our board of directors and its chairman since October 2016. Mr. Hastings is the Chief Executive Officer of Nkarta Therapeutics, Inc. Prior to joining Nkarta in 2018, Mr. Hastings was Chairman and Chief Executive Officer of OncoMed Pharmaceuticals (Nasdaq: OMED) from 2006 to 2018. Prior to joining OncoMed, Mr. Hastings was President and Chief Executive Officer of QLT, Inc. Previous to that, Mr. Hastings served as President and Chief Executive Officer of Axys Pharmaceuticals, which was acquired by Celera Corporation in 2001. From 1999 to 2001, Mr. Hastings served as the President of Chiron BioPharmaceuticals, a division of Chiron Corporation. Prior to that, he was President and Chief Executive Officer of LXR Biotechnology. Mr. Hastings also held a series of management positions of increasing responsibility at Genzyme Corporation, including serving as President of Genzyme Therapeutics Europe as well as President of Worldwide Therapeutics. Mr. Hastings also served as Vice President, Marketing and Sales and General Manager, Europe for Synergen, Inc., and previously held a series of marketing and sales management positions with Hoffmann-La Roche. Mr. Hastings served as chairman of the board of Proteolix (sold to Onyx Pharmaceuticals in 2010), and served on the boards of ViaCell (previously a public company (Nasdaq: VIAC) sold to Perkin-Elmer in 2007), Cerimon Pharmaceuticals and Relypsa Pharmaceuticals (previously a public company (Nasdaq: RLYP) sold to Galenica in 2016). He is currently on the board of Pacira Pharmaceuticals (Nasdaq: PCRX), serves as Vice Chairman of Biotechnology Innovation Organization, and is also on the board of directors of the California Life Sciences Association. Mr. Hastings received a B.S. in pharmacy from the University of Rhode Island. We believe Mr. Hastings is qualified to serve as a member of our Board because of his operational knowledge of, and executive level management experience in the biopharmaceutical industry.

Stuart A. Kingsley has been a member of our Board since October 2015. Mr. Kingsley served as President and Chief Operating Officer at The Medicines Company (Nasdaq: MDCO) from May 2016 to December 2017. Previously, Mr. Kingsley served as Executive Vice President, Global Commercial Operations at Biogen from November 2011 to October 2015. From January 2010 to November 2011, Mr. Kingsley was Biogen’s Senior Vice President, U.S. Commercial Operations. Prior to that, he was Senior Vice President and General Manager of the Gynecological Surgical Products business at Hologic, Inc., from October 2007 to November 2009, and Division President, Diagnostic Products at Cytyc Corp., from July 2006 to October 2007. From 1991 to 2006, he was a Partner at McKinsey & Company, focusing on the biotechnology, pharmaceutical and medical device industries. Mr. Kingsley received a B.A. in government from Dartmouth College and an M.B.A. from Harvard Business School. We believe Mr. Kingsley is qualified to serve as a member of our Board because of his extensive management and operational experience as a senior executive in public healthcare and biopharmaceutical companies.

Jonathan Leffhas served as a member of our board of directors since January 2020. Dr. Levy also currently serves on the board of directors of Kodiak Sciences Inc., Kiniksa Pharmaceuticals, Ltd., Madrigal Pharmaceuticals, Inc. and Constellation Pharmaceuticals Inc., each a publicly traded pharmaceutical company. Dr. Levy previously served on the board of directors of Aquinox Pharmaceuticals, Inc., a publicly traded pharmaceutical company, from March 2017 until March 2019. Previously, from December 2016 until May 2019, Dr. Levy served as a part-time senior advisor for Baker Bros. Advisors, L.P., a firm that primarily manages long-term investment funds focused on publicly traded life sciences companies. Dr. Levy served as executive vice president and chief drug development officer at Incyte from January 2009 until his retirement in April 2016, and as senior vice president of drug development at Incyte from August 2017. Mr. Leff is a Partner of Deerfield Management Company, L.P. and Chairman of the Deerfield Institute. He joined Deerfield in 2013, and focuses on venture capital and structured investments in biotechnology and pharmaceuticals.2003 until January 2009. Prior to joining Deerfield, forIncyte, Dr. Levy served as vice president, biologic therapies, at Celgene Corporation, a publicly-held biopharmaceutical company, from 2002 until 2003. From 1997 until 2002, Dr. Levy served in various executive positions with DuPont Pharmaceuticals Company, first as vice president, regulatory affairs and pharmacovigilence, and thereafter as vice president, medical and commercial strategy. Dr. Levy served at Novartis, and its predecessor company, Sandoz, from 1991 until 1997 in positions of increasing responsibility in clinical research and regulatory affairs. Prior to joining the pharmaceutical industry, Dr. Levy served as an assistant professor of medicine at the UCLA School of Medicine. Dr. Levy is board certified in internal medicine and gastroenterology and received his A.B. in biology from Brown University, his M.D. from the University of Pennsylvania School of Medicine, and completed his training in internal medicine at the Hospital of the University of Pennsylvania and a fellowship in gastroenterology and hepatology at UCLA. Our nominating and corporate governance committee and board believes that Dr. Levy’s more than sixteen30 years Mr. Leff was with Warburg Pincus, where he ledof experience in the firm’s investment efforts inpharmaceutical and biotechnology and pharmaceuticals. Mr. Leff has also been active in public policy discussions relatedindustries, as well as his extensive board experience, qualifies him to healthcare and medical innovation. He is a memberserve on our board of several not-for-profit boards, including the Spinal Muscular Atrophy Foundation, Friends of Cancer Research, the Reagan-Udall Foundation for the Food and Drug Administration and the Columbia University Medical Center Board of Advisors. In addition, he previouslydirectors.

Michael Solomon, Ph.D. served as a member of the Boardboard of Directorsdirectors of Private ArTara from May 2018 until the Biotechnology Innovation OrganizationMerger, and a member of the Executive Committee of the Board of the National Venture Capital Association (NVCA). He also previouslyhas served on the boards of several other publicly-traded biotechnology and pharmaceuticals companies, namely InterMune, Inc., Talon Therapeutics, Inc., Allos Therapeutics, Inc., Inspire Pharmaceuticals, Inc., Sophiris Bio Inc., Nivalis Therapeutics, Inc., AveXis, Inc. and Audentes Therapeutics. Previously he led NVCA’s life sciences industry efforts as Chair of NVCA’s Medical Innovation and Competitiveness Coalition (NVCA-MedIC). Mr. Leff received his A.B. from Harvard University, and earned his M.B.A. from the Stanford University Graduate School of Business. We believe Mr. Leff is qualified to serve as a member of our Board becauseboard of his investment, board and leadershipdirectors since January 2020. Dr. Solomon has more than 20 years of experience in the biotechnology industry and has spent the last 14 years focused on creating and operating early stage companies. Dr. Solomon has served as chief executive officer of Ribometrix, Inc., a privately held therapeutics company focused on targeting RNA with small molecules, since October 2017. Dr. Solomon served as a venture partner at SV Health Investors from December 2016 until December 2018. Previously, Dr. Solomon served as chief operating officer at Decibel Therapeutics, Inc., a biotechnology company focused on hearing disorders, from 2015 until 2016.

9

Dr. Solomon served as chief operating officer of Ember Therapeutics, Inc., a publicly traded pharmaceutical company, from 2012 until 2015, and as chief business officer of Link Medicine Corporation, a privately held biopharmaceutical company, from 2009 until 2012. Dr. Solomon was a founder and vice president of discovery at Epizyme Therapeutics, Inc., a clinical stage biopharmaceutical company, and vice president of discovery at Hypnion, Inc., a sleep disorder company that was sold to Lilly in 2007. Dr. Solomon currently serves on the board of directors of Ribometrix, Inc., a privately held platform therapeutics company. Dr. Solomon earned his B.S. in chemistry from the University of Massachusetts, Amherst and his Ph.D. in organic chemistry from the University of Wisconsin. Our nominating and corporate governance committee and board believes that Dr. Solomon’s industry experience in creating and operating early stage companies qualifies him to serve on our board of directors.

Directors Continuing in Office Until the 2022 Annual Meeting of Stockholders

Luke Beshar served as a member of the board of directors of Private ArTara from October 2018 until the Merger, and has served as Chairperson of our board of directors since January 2020. Mr. Beshar has over 30 years of experience in serving as chief financial officer and in executive leadership roles principally for publicly traded and privately-held pharmaceutical companies. Mr. Beshar has served on the board of directors of Trillium Therapeutics Inc., a publicly traded immuno-oncology company, since March 2014 and is currently chair of its audit and compensation committees. Mr. Beshar has served on the board of directors of REGENXBIO, Inc., a publicly traded leading clinical-stage gene therapy company, since May 2015 and is currently chair of its audit committee. Previously, Mr. Beshar served as executive vice president, chief financial officer of NPS Pharmaceuticals, Inc., a publicly traded global biopharmaceutical company focused on rare diseases, from 2007 until February 2015 when the company was acquired by Shire plc. Prior to NPS Pharmaceuticals, Mr. Beshar served as executive vice president, chief financial officer of Cambrex Corporation, a publicly traded manufacturer of branded and generic active pharmaceutical ingredients and provider of related services from 2002 until 2007. Mr. Beshar began his career with Arthur Andersen & Co. and is a certified public accountant. Mr. Beshar earned his B.A. in accounting and financial administration from Michigan State University and is a graduate of The Executive Program at the Darden Graduate School of Business at the University of Virginia. Our nominating and corporate governance committee and board believes that Mr. Beshar’s executive leadership and financial experience and his extensive director experience on other publicly held biotechnology companies qualifies him to serve on our board of directors.

Roger Garceau, M.D. served as a member of the board of directors of Private ArTara from January 2019 until the Merger, and has served as a member of our board of directors since January 2020. Dr. Garceau has more than 30 years of broad pharmaceutical industry experience. He has served as a member of the board of directors of Entera Bio Ltd., a biotechnology company specializing in the oral delivery of large molecules and biologics, and has served as its chief development advisor since December 2016. Prior to joining Entera, Dr. Garceau served as chief medical officer and executive vice president of NPS Pharmaceuticals, Inc., a publicly traded pharmaceutical company that specialized in drugs for gastrointestinal disorders, since December 2008 and January 2013, respectively, until February 2015, when NPS Pharmaceuticals was acquired by Shire plc. Previously, Dr. Garceau has also served in several managerial positions with NPS Pharmaceuticals, Inc., Sanofi-Aventis and Pharmacia Corporation. Dr. Garceau has served as a member of the board of directors of Enterome SA, a privately held clinical-stage biopharmaceutical company, since December 2016. Dr. Garceau is a board-certified pediatrician and is a fellow of the American Academy of Pediatrics. Dr. Garceau earned his B.S. in biology from Fairfield University and his M.D. from the University of Massachusetts Medical School. Our nominating and corporate governance committee and board believes that Dr. Garceau’s pharmaceutical industry experience, both in management and at the board level, qualifies him to serve on our board of directors.

Gregory Sargen served as a member of the board of directors of Private ArTara from November 2019 until the Merger, and has served as a member of our board of directors since January 2020. Mr. Sargen most recently served as Chief Financial Officer and Executive Vice President, Corporate Development and Strategy of Cambrex Corporation, a global manufacturer and provider of services to life sciences industry.

companies, from January 2017 until January 2020, following the December 2019 acquisition of Cambrex by a private equity company. Mr. Sargen previously served in various roles at Cambrex from February 2007 to January 2017, including as Executive Vice President, Corporate Development and Strategy, Chief Financial Officer, and Vice President, Finance. Prior to Cambrex, Mr. Sargen served as Executive Vice President, Chief Financial Officer of Expanets, Inc., a communications company, from 1999 until 2002, as Vice President of Finance at Fisher Scientific International, Inc.’s chemicals manufacturing division, from 1996 until 1998, and held various positions in finance, accounting and auditing with Merck & Co., Heat and Control, Inc. and Deloitte & Touche LLP. Mr. Sargen also serves on the boards of Avid Bioservices, Inc., a publicly traded contract manufacturer focused on the development and manufacture of biopharmaceuticals derived from mammalian cell culture, and Kindeva Drug Delivery, L.P., a privately owned contract manufacturer and developer of

10

Table of ContentsCORPORATE GOVERNANCE

complex drug delivery systems. Mr. Sargen is a Certified Public Accountant (non-practicing) and earned his B.S. in accounting from Pennsylvania State University and his MBA in finance from The Wharton School of the University of Pennsylvania. Our nominating and corporate governance committee and board believes that Mr. Sargen’s industry experience, both in management and at the board level, qualifies him to serve on our board of directors.

Directors Continuing in Office Until the 2023 Annual Meeting of Stockholders

Jesse Shefferman co-founded Private ArTara and served as its Chief Executive Officer and a member of its board of directors from November 2017 until the Merger, and has served as our Chief Executive Officer and a member of our board of directors since January 2020. Prior to co-founding Private ArTara, Mr. Shefferman served as vice president and head of business development at Retrophin Inc., a publicly traded company focusing on rare diseases, from March 2014 until October 2017. Prior to Retrophin, Mr. Shefferman served as director, strategy & business development at Vertex Pharmaceuticals, Inc., a publicly traded biopharmaceutical company, from September 2012 until March 2014. Mr. Shefferman previously served as an investment banker with Barclays Capital and Lehman Brothers. Mr. Shefferman earned his B.A. in accounting from Gordon College and his MBA and certificate in health sector management from Duke University’s Fuqua School of Business. Our nominating and corporate governance committee and board believes that Mr. Shefferman’s experience in strategy, management and financial roles in the biopharmaceutical industry qualifies him to serve on our board of directors.

Barry P. Flannelly, Pharm.D., MBA has served as a member of our board of directors since July 2020. Dr. Flannelly has served as Executive Vice President and General Manager US of Incyte Corporation, a publicly traded biopharmaceutical company, since June 2015 and joined Incyte as Executive Vice President, Business Development and Strategic Planning in August 2014. Prior to joining Incyte, he served as Chief Executive Officer of OSS Healthcare Inc., a biotechnology start-up company, from August 2013 to July 2014. Dr. Flannelly also served as Vice President, Global Product Strategy and Commercial Planning of Nektar Therapeutics, a biopharmaceutical company, from April 2011 until April 2013, and as Senior Vice President, Commercial, of Onyx Pharmaceuticals, Inc., a biopharmaceutical company, from August 2008 until January 2011. Prior thereto, Dr. Flannelly held key positions at biopharmaceutical and pharmaceutical companies such as Abraxis BioScience, Inc. and Novartis Pharmaceuticals Corporation. Dr. Flannelly earned his Pharm.D. from the University of Maryland, School of Pharmacy, his MBA from the University” of Baltimore and his B.S. degree in Pharmacy from Massachusetts College of Pharmacy. Our nominating and corporate governance committee and board believe that Dr. Flannelly’s pharmaceutical and biotechnology industry experience, both in management and at the board level, qualifies him to serve on our board of directors.